The GCC is often described as a fast-growing SaaS opportunity, but growth alone doesn’t explain why some products gain traction while others stall early. What really matters is how the market evaluates software, vendors, and early-stage products.

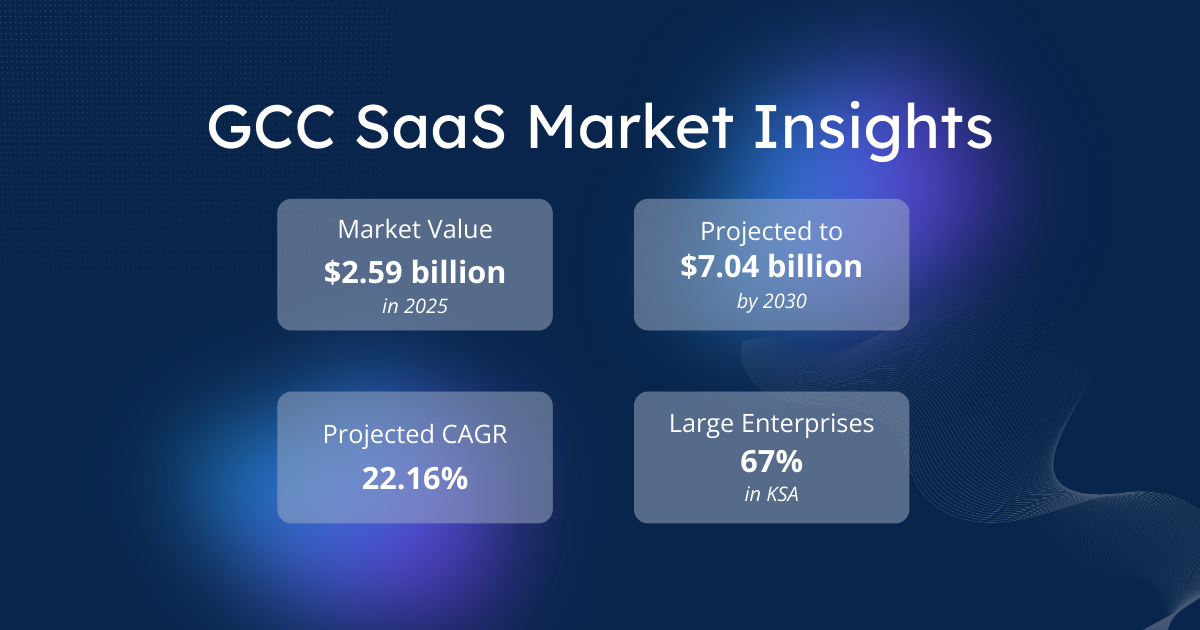

In this market, large enterprises accounted for 67% of the digital transformation in 2025, according to Mordor Intelligence. Buyers are typically enterprises and government entities, not early adopters willing to experiment.

That’s why early decisions around scope, polish, and architecture carry more weight in the GCC. These choices quickly shape how buyers perceive reliability and long-term commitment.

This article breaks down how the GCC SaaS market works in practice, what buyers expect, and how those expectations should shape your product development and operating model from day one.

Understanding the GCC SaaS Market, and What It Expects from Your Product

The GCC SaaS market has grown quickly. Its structure, spending patterns, and regulatory environment shape how software is evaluated and adopted.

How GCC Buyers Evaluate Early SaaS Products

Software adoption in the GCC is closely tied to national digital transformation programs, like Vision 2030, and large-scale institutional spending.

The GCC SaaS market size was projected by Statista to reach $2.59B in 2025, driven largely by government and enterprise demand.

Saudi Arabia’s DGA report shows that it allocates over a third of its public sector spending to telecommunications and IT, with the UAE and other GCC countries following similarly ambitious digital transformation agendas.

The GCC’s SaaS growth reflects sustained investment in digital infrastructure and local data centers.

These digitization efforts have also accelerated cloud adoption in establishments across the region, reported by General Authority for Statistics in Saudi at about 47% in 2024, increasing demand for SaaS platforms that can scale reliably.

How do Buyers Evaluate Your Product?

In GCC business culture, software purchasing decisions are less about experimentation and more about long-term partnership. Buyers are not only evaluating what your product does today, but whether your company can be a reliable vendor over time.

Early product quality acts as a proxy for vendor maturity. Stability, usability, and operational readiness signal how seriously you approach delivery, support, and future commitments.

Unlike markets where fast iteration is expected and imperfections are tolerated, GCC decision-makers often interpret early instability or rough execution as risk. Product polish is not about aesthetics, it is about trust, accountability, and the ability to operate at enterprise scale.

Understanding this mindset is critical. Founders are not just launching software into a fast-growing market, they are entering an environment where early signals shape long-term perception.

What This Means for MVPs and Product Standards in the GCC

Given how buyers evaluate vendors, SaaS product development requires rethinking what “minimum viable” actually means. “Good enough” often fails to build the confidence buyers need.

While Western startups may launch with minimal features and iterate publicly, GCC buyers expect a baseline of stability, clarity, and operational readiness, even in early-stage products.

This does not mean building more features. It means building the right level of completeness.

In practice, GCC buyers often expect even early-stage SaaS products to demonstrate:

-

- Clear, intuitive UX with minimal friction

- Reliable performance under enterprise usage scenarios

- Professional design and branding

- Responsive support infrastructure

- Data security and governance considerations

You can still launch lean, but the execution quality of what you ship needs to meet enterprise standards from day one.

Once you understand how GCC buyers evaluate early SaaS products, the next challenge becomes deciding what to build first, and how complete that first version really needs to be.

Balancing MVP Scope, Scalability, and Control in GCC SaaS Development

Building a SaaS product that meets market expectations requires making dozens of decisions about what to build, how to build it, and how to structure it for growth.

Every choice about scope, architecture, and technology becomes part of your long-term foundation. To navigate these complexities, here are the most critical trade-offs you will need to consider:

Speed vs Completeness: Finding the Right MVP Balance

Every SaaS founder faces the tension between moving fast and building responsibly. The question is what goes into version one, and the answer is distinguishing must-have features from nice-to-have ones.

Must-have features directly enable your core value proposition. Features that add convenience can wait until you’ve validated the core workflow.

Smart founders validate assumptions quickly, and launch with a focused feature set that solves a real problem completely, rather than solving many problems partially.

They use feedback from early enterprise clients to refine the product iteratively, adding features based on actual usage patterns.

But deciding what goes into an MVP is only part of the equation. How that MVP is built can determine whether early success becomes a foundation for growth, or a source of costly rework later.

Scalability vs Technical Debt: Planning for Growth Without Risk

Every startup faces pressure to move fast. In SaaS application development in the GCC, moving fast without creating technical debt requires deliberate planning.

Technical debt is expensive. Engineering teams spend a considerable portion of their time managing technical debt rather than building new features.

The cost compounds as the product scales. Early shortcuts that save weeks of development time can create months of rework as the product scales.

The solution is not over-engineering. It is designing architecture with realistic growth scenarios in mind.

If your product targets GCC enterprises, you should plan for multiple clients with different access levels, structured data separation, and clear permission models from the start.

This means:

- Writing modular code that can expand without rewrites

- Predicting enterprise user adoption, and growth patterns.

- Choosing frameworks that balance speed with maintainability

The question founders should ask is not “what’s the fastest way to ship this feature?” It is “what’s the fastest way to ship this feature without creating problems we’ll need to fix in six months?“

Technology choices also play a role, not in terms of specific tools, but in how well they support both speed and stability.

Rapid Iteration vs Stable Foundations: Choosing the Right Tech Stack

Your technology stack determines how fast you can iterate and how stable your foundation will be as you grow.

For SaaS startups, this means balancing flexibility with robustness. Modern frameworks allow rapid development, but not all frameworks scale well under enterprise usage.

The right stack for SaaS product development in the GCC typically includes:

- Frameworks that support fast iteration without sacrificing stability

- Cloud deployment options that align with regional data governance requirements

- Automated testing and CI/CD pipelines that allow you to ship updates safely

Tools matter less than principles:

- Choose technologies that let you move quickly now while supporting enterprise-grade performance later

- Avoid proprietary platforms that lock you into vendor-specific ecosystems

- Prioritize modularity so you can swap components as requirements evolve

Beyond code and tooling, founders also need to think about how their SaaS product is structured and operated as it serves multiple customers across the GCC, often with different requirements.

Scalability Models That Enable Growth Without Losing Control

Growth is not only about handling more users. It is about supporting different buyer expectations, regulatory requirements, and growth paths without rebuilding.

As you add clients, the right model provides flexibility, cost efficiency, and easier updates by sharing core infrastructure while supporting client-specific requirements.

This flexibility is typically achieved through a few common architecture approaches:

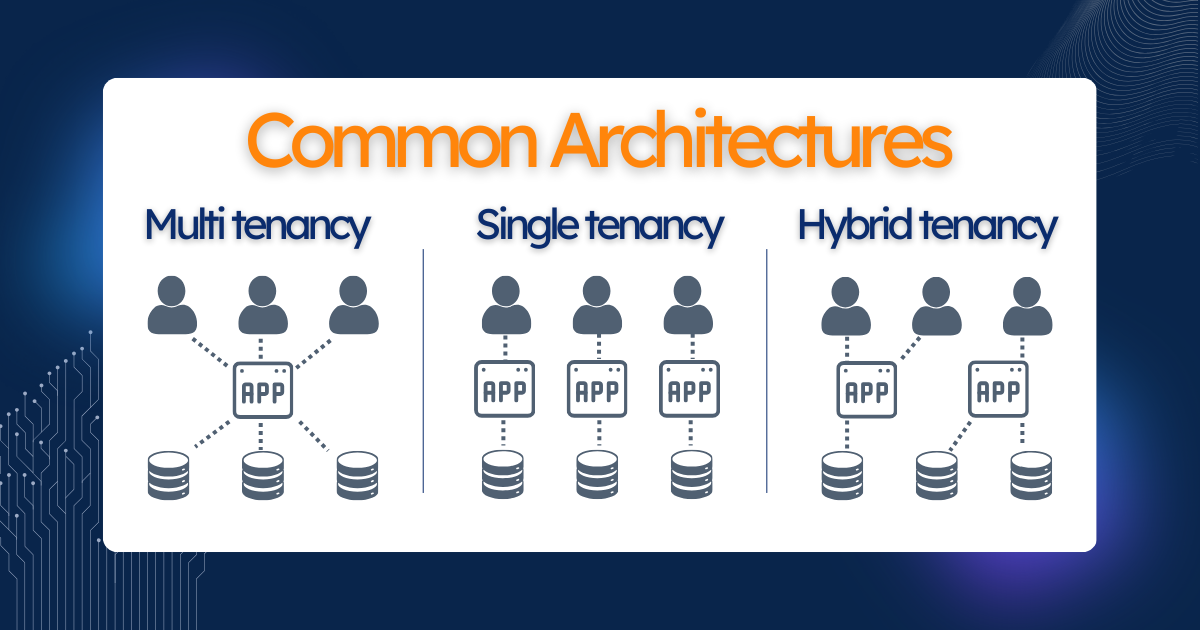

1. Multi-tenancy:

Many SaaS products start with a multi-tenant model, where customers share core infrastructure while their data is logically isolated. This model offers several advantages:

- Centralized updates, and configurable customizations

- Easy customer onboarding & fast iteration

- Lower cost than dedicated environments

This makes it well-suited for early growth and mid-market clients.

2. Single-tenant architecture:

Each customer operates in a dedicated environment, providing strong data isolation per customer and higher confidence around compliance and data governance.

This is usually preferred in regulated environments, such as government, healthcare, or large enterprises in Saudi Arabia and the UAE.

3. Hybrid tenancy models:

A shared core platform with isolated components for sensitive data or regulated workloads.Advantages:

- Flexible balance of efficiency and isolation

- Reduces product fragmentation while scaling

- Meets regulatory expectations without duplication

This supports both mid-market and enterprise clients. Rather than choosing between speed or control, hybrid models allow founders to design for both.

The key advantage of these models is optionality. They allow founders to build a SaaS product for the GCC that can adapt with requirements, regulations, and scale, without slowing down early momentum or losing control over the product.

Execution Realities for Scaling SaaS Products in the GCC

Execution is the bridge between a robust architecture and market dominance. The difference between leaders and laggers often comes down to organizational agility and the ability to navigate a fragmented regulatory landscape.

Team Structures That Support SaaS Growth

Relying on task-driven delivery risks creating a “feature factory” that lacks strategic direction. To scale effectively in the GCC, startups are increasingly adopting Product-Led Growth (PLG) structures.

In practice, this means structuring teams around responsibility for outcomes, not just delivery. A scalable setup typically includes:

- Product leadership close to the market to manage roadmap and enterprise feedback

- Dedicated engineering teams with cultural and language proximity.

- Clear ownership across product, engineering, and quality

- Shared goals tied to product adoption and reliability, not feature output

Dedicated teams can be built in-house or extended through external partners. What matters is continuity, context, and accountability over time.

Nearshore teams work particularly well in this setup. They provide access to experienced SaaS talent, time-zone overlap, and cost efficiency, while operating as long-term extensions of the core product team rather than short-term delivery resources.

To learn how to manage nearshore teams effectively and maintain collaboration, see our guide for some practical tips..

Common Patterns That Cause SaaS Products to Struggle

Even with the right architecture, execution missteps can stall growth. A common pitfall in the GCC is the “Whale Client Trap”. Founders often over-customize for their first large client, underestimating how these changes affect future customers.

Treating the GCC as one uniform market or scaling sales faster than the product can handle introduces systemic issues.

Some other common pitfalls include:

- Underestimating onboarding and support requirements

- Accumulating hidden technical or organizational debt

- Failing to standardize processes across distributed teams

These patterns highlight that early shortcuts or assumptions can quietly limit growth. Avoiding them ensures a SaaS product in the GCC can scale across multiple clients without operational friction.

Conclusion

The GCC SaaS market rewards focus, execution quality, and long-term thinking. Successful products are stable, intentional, and built with enterprise realities in mind.

From defining what an MVP needs to signal quality, to making deliberate trade-offs around scalability, architecture, and team structure, the difference lies in building for credibility as much as functionality.

If you’re planning to build or scale a SaaS product for the GCC, getting these foundations right is often what separates early traction from long-term growth. At Pharos Solutions, we help founders design, build, and scale SaaS products that meet enterprise expectations from day one.

Book a free consultation and let’s explore how we can help you set your SaaS product up for success in the GCC.

FAQs

How to build a SaaS based application?

|

A SaaS-based application is built by defining a clear core problem, designing a focused MVP, and implementing scalable architecture that supports multiple customers. From there, development should prioritize modular design, stable workflows, and operational readiness. Rather than starting with tools, successful SaaS products are built around clear product logic and delivery models that allow iteration without accumulating long-term technical debt. In GCC markets, early emphasis on stability and reliability is especially important. |

How is SaaS application development in the GCC different from other markets?

GCC buyers are primarily enterprises and government entities. They expect operational maturity, stability, and polished user experience from day one.

Unlike consumer markets, early experimentation is less tolerated, so SaaS product development in Saudi Arabia, UAE, and the wider GCC requires a focus on trust, compliance, and readiness for scale.

What are the biggest SaaS scaling challenges in GCC markets?

The biggest SaaS scaling challenges in GCC markets involve balancing enterprise customization with long-term product scalability.

Over-customizing for early large clients, navigating regulatory requirements, managing technical debt, and aligning distributed teams are common pitfalls. Sustainable growth depends on disciplined scope control and strong architectural foundations.

Do SaaS startups need to localize for every GCC country?

SaaS startups do not need to fully localize for every GCC country at launch, but they must design their products to support localization over time.

Core requirements like Arabic support, right-to-left UI/UX, and regional compliance should be baked in from day one.

Full localization can be incremental, but a GCC-ready product must anticipate cultural and operational differences between countries.

What kind of development team works best for GCC-focused SaaS startups?

GCC-focused SaaS startups perform best with long-term, product-oriented development teams rather than short-term task-based delivery models.

Effective teams combine strong product leadership, dedicated engineering groups, and clear ownership.

Nearshore teams often work well when they offer continuity, time-zone alignment, and cultural proximity, enabling consistent quality as the product scales.